Dream11’s what happened India’s leading fantasy sports platform once celebrated as a shining example of startup success.

Imagine building a unicorn worth $8 billion, only to see its valuation wiped out overnight by a single court order.

From dominating cricket sponsorships to securing billions in funding, Dream11 was the poster child of India’s fast-growing gaming industry.

But in 2025, a Supreme Court ruling reclassified its core model from a “game of skill” to “betting and gambling,” instantly dismantling its foundation.

This landmark judgment didn’t just affect one company — it exposed how fragile even billion-dollar valuations can be when regulatory risks are overlooked.

In this blog, we’ll use Dream11 as a case study to explain how business valuation in India is directly shaped by court orders, compliance, and external shocks — and what startups, investors, and regulators can learn from it.

Key Takeaways

✅ Court rulings can erase billions overnight

✅ Revenue assumptions are fragile without compliance checks

✅ Intangible assets like sponsorships and goodwill hold hidden value

✅ Certified valuations provide resilience and investor trust

The Court Ruling That Triggered Dream11’s Collapse

Dream11’s meteoric rise was built on the legal positioning of fantasy sports as a “game of skill” rather than gambling. For years, this classification gave the company legitimacy and investor confidence.

But in August–September 2025, the Supreme Court of India issued a landmark ruling that overturned this narrative. The court declared certain real-money fantasy sports activities to be “betting and gambling,” not skill-based games .

According to Reuters, the decision was devastating:

“The Supreme Court ruling effectively banned real-money fantasy sports, forcing Dream11 to exit its ₹358 crore sponsorship deal with the BCCI.”

Reuters – India seek new sponsor after online betting games ban ends Dream11 deal

This ruling wiped out Dream11’s primary revenue stream almost overnight, with analysts estimating a 95% revenue loss in FY2025.

AInvest reported:

“Dream11’s valuation, once pegged at $8 billion, is expected to plummet sharply as its business model has been rendered unviable.”

AInvest – Dream11 valuation expected to plummet amid gaming ban

The fallout was immediate. Investors began writing down their stakes, market confidence evaporated, and the company’s brand credibility took a hit.

This case highlights a critical truth: in India, legal and regulatory clarity is not just compliance — it’s a valuation driver. A single judgment can transform a unicorn into a distressed asset overnight.

How Court Orders Directly Impact Business Valuation

Business valuation in India isn’t only about revenues and profits — it’s also about legal certainty. A single court ruling can change assumptions that billions of dollars depend on.

When the Supreme Court of India reclassified Dream11’s core operations as gambling, the effect on valuation models was immediate. The ruling didn’t just affect user participation — it collapsed the company’s very foundation.

In Discounted Cash Flow (DCF) models, future revenue streams drive enterprise value. With 95% of Dream11’s revenues at risk post-ruling, the cash flow projections became irrelevant overnight.

Market-based valuations (multiples like EV/EBITDA or EV/Revenue) also crashed. As Economic Times noted, investors feared billions in losses for PE funds like Tiger Global and Accel that had bet heavily on Dream11 .

Intangible assets, such as sponsorships and brand goodwill, were another casualty. The cancellation of the ₹358 crore BCCI sponsorship deal instantly reduced Dream11’s intangible valuation .

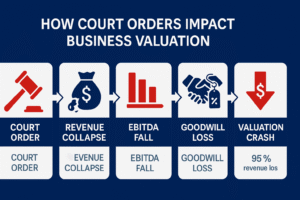

Here’s the 5-step chain reaction that explains Dream11’s fall:

- Court Order → Business model invalidated

- Revenue Collapse → 95% cash flows vanish

- EBITDA & Multiples Fall → Investor markdowns

- Goodwill Erosion → Loss of BCCI sponsorship & brand trust

- Valuation Crash → Unicorn status wiped out

This shows why legal and regulatory risks must be embedded in valuation models. Ignoring them can turn optimistic projections into worthless numbers overnight.

Dream11 Case Study – From Unicorn to Uncertain

Dream Sports (parent of Dream11) hit $8B valuation after raising $840M in Nov 2021 from Falcon Edge, Tiger Global, D1 Capital, RedBird, TPG and others; the group reported ~140M users across brands. ReutersThe Economic Times

In 2023, Dream11 signed a three-year front-of-jersey deal with BCCI reportedly worth ₹3.58–3.6 billion through 2026, cementing its status as India’s fantasy-sports unicorn. Reuters+1

August 2025: Parliament passed the Promotion & Regulation of Online Gaming Bill, 2025, moving to ban real-money online games and associated ads and payment rails. “The legislation aims to prohibit real-money games nationwide—whether based on skill or chance.” TechCrunch

Within days, Dream11 and other top apps suspended money-based contests, and gaming stocks wobbled as the sector’s outlook darkened. Reuters

Late Aug 2025: Dream11 entered talks to terminate the BCCI jersey deal to comply with the new law, triggering a scramble before the Asia Cup. Reuters

Sep 2, 2025: BCCI formally sought a new lead sponsor after the ban ended Dream11’s role; media pegged the prior agreement at ₹3.6B and bid targets at ~₹4.52B over the next cycle. Reuters

Sep 4, 2025: The Union government moved the Supreme Court to consolidate multiple challenges to the new Act, underscoring continuing legal uncertainty for real-money gaming. (Separately, A23 had already mounted the first legal challenge.) The Economic TimesReuters

Brand fallout showed up fast: ahead of the Asia Cup, official India jerseys were discounted up to 80%, after Dream11’s branding vanished with the sponsorship exit. The Times of India

What this timeline shows: In a matter of weeks, a company once valued at $8B went from market-making deals to model uncertainty—a live illustration of how law and policy shocks can reset business valuation in India almost overnight.

Lessons for Startups, Investors, and Regulators

Dream11’s collapse is more than a headline — it’s a playbook of valuation lessons for the ecosystem.

For Startups:

Valuation models must include regulatory risk stress-testing. Over-reliance on user growth and optimistic revenue projections can be fatal if a law changes.

“Startups should scenario-plan for compliance shocks — revenue falling by 50% or vanishing overnight.”

For Investors:

PE and VC funds like Tiger Global and Accel faced steep markdowns on Dream11. Diversification and realistic multiples are essential when investing in high-risk sectors like gaming, crypto, or edtech.

Reuters – Investors brace for Dream11 markdowns

For Regulators:

Sudden bans and court orders send shockwaves through valuations, employment, and capital markets. Gradual, clear regulatory frameworks ensure both investor protection and sector stability.

ET Prime – Gaming law sparks uncertainty

“Dream11’s valuation crash teaches key lessons: startups must model legal risks, investors should diversify across regulated industries, and regulators need clear frameworks. Without these safeguards, even billion-dollar valuations in India can vanish overnight.”

Intangible Assets & Sponsorship Loss – The Hidden Factor

Valuation isn’t just about cash flows — intangibles like brand value, partnerships, and goodwill often make up a big share of a unicorn’s worth.

Dream11’s ₹3.6 billion front-of-jersey deal with BCCI was more than a sponsorship — it was a signal of credibility to fans, regulators, and investors alike .

When the Supreme Court ruling forced Dream11 to exit this partnership, it lost not only a contract but also its intangible asset premium. Overnight, jerseys had to be redesigned, and official India kits were discounted by up to 80% to clear out Dream11-branded stock .

In valuation terms, that meant a steep decline in brand goodwill — the kind of asset that’s tough to quantify but easy to lose.

This illustrates why intangible valuation in India is critical. Brand equity, user trust, and strategic partnerships can swing company value as much as EBITDA or revenue.

“Dream11’s exit from its ₹3.6B BCCI sponsorship shows how intangible assets like brand partnerships and goodwill directly impact valuation. When sponsorships collapse, the loss of credibility and brand equity can wipe out billions — making intangible valuation essential in India’s startup ecosystem.”

Protecting Valuation Against Legal & Regulatory Risks

Dream11’s story proves that even billion-dollar companies can’t rely on revenue projections alone — valuations must be stress-tested against legal and regulatory risks.

Certified valuers often use scenario planning to model outcomes such as:

- ✅ What if revenue falls 50% due to a ban?

- ✅ What if a key contract is terminated?

- ✅ What if compliance costs double?

In Discounted Cash Flow (DCF), that means building multiple cases — base, optimistic, and regulatory downside. This ensures investors see how enterprise value shifts under different assumptions.

Under SEBI and IBC frameworks, defensible valuations are required for fundraising, IPOs, and restructuring. Companies that skip this step risk investor mistrust when external shocks hit.

Read more : understanding valuation under ibc a comprehensive guide

Global studies show intangible assets contribute 50–70% of enterprise value in tech startups — meaning a court-driven sponsorship loss can be as damaging as revenue collapse.

“To protect business valuation in India, companies must stress-test models for regulatory and legal risks. Certified valuations under SEBI and IBC ensure defensibility, investor trust, and resilience against shocks like Dream11’s collapse, where revenue and intangibles evaporated almost overnight.”

Conclusion

Dream11’s collapse is a wake-up call: valuation isn’t just about numbers — it’s about law, compliance, and risk. One Supreme Court ruling reclassified its business, and a unicorn worth $8B saw its foundation crumble overnight.

For startups, this means building resilient valuation models that account for legal uncertainty. For investors, it means demanding stress-tested, defensible valuations before deploying capital. And for regulators, it highlights the importance of clear, gradual policy to avoid destabilizing billion-dollar industries.

At RNC, we specialize in certified valuations that factor in legal, regulatory, and compliance risks. Whether you are preparing for fundraising, IPO, M&A, or restructuring, our expertise ensures your valuation is not just attractive — it’s defensible.

“Partner with RNC to safeguard your company’s valuation, protect investor confidence, and build resilience against regulatory shocks.”

FAQs

1. Why did Dream11’s valuation decline?

Dream11’s valuation declined due to regulatory uncertainty, sustainability concerns around revenue models, and increased scrutiny of gaming sector valuations.

2. Can high revenue still lead to valuation correction?

Yes. If revenue growth is not supported by strong cash flows, predictable earnings, and regulatory stability, valuations may correct despite high topline numbers.

3. What valuation mistake should investors avoid from this case?

Investors should avoid relying solely on comparable company multiples without adjusting for regulatory risks, market maturity, and business-specific fundamentals.

4. How do regulatory risks impact business valuation?

Regulatory risks can directly affect future cash flows, business continuity, and investor confidence, leading to significant valuation discounts.

5. What is the key takeaway for business valuers?

Business valuers must incorporate regulatory risk, cash flow sustainability, and scenario analysis to ensure realistic and defensible valuation outcomes.

About the author:

Sahil Narula

Sahil Narula is the Managing Partner at RNC Valuecon LLP and a Registered Valuer with IBBI. He brings over a decade of experience in Valuation Services, Corporate Finance, and Advisory, having led numerous complex assignments under the Insolvency & Bankruptcy Code, 2016, Mergers & Acquisitions, Insurance, and Financial Reporting.

He is a regular speaker at national forums (ASSOCHAM, CII, ICAI, IBBI, Legal Era) and currently serves as Co-Chairman of ASSOCHAM’s National Council on Insolvency & Valuations and a member of CII’s Task Force on Insolvency & Bankruptcy.

🤝Connect with Sahil on LinkedIn.

Lessons for Investors & Business Valuers from Dream11 Valuation Crash

Revenue ≠ Valuation Sustainability

High revenue growth alone does not guarantee long-term valuation. Sustainable valuations depend on profitability, cash flow stability, and long-term business fundamentals—not topline figures alone.

Risk of Regulatory Dependency

Businesses heavily dependent on regulatory approvals or favorable legal interpretations face valuation volatility. Regulatory uncertainty can significantly reduce enterprise value overnight.

Cash Flow Matters More Than Hype

Valuations driven by user growth and brand hype often ignore weak or inconsistent cash flows. Cash flow visibility remains the strongest indicator of valuation resilience.

Comparable Valuation Mistakes

Applying global tech or gaming multiples without adjusting for market maturity, regulation, and geography can lead to inflated valuations and incorrect benchmarks.

Importance of Robust Due Diligence

Independent valuation and financial due diligence help investors identify hidden risks, ensuring valuation assumptions are realistic and defensible.

Dream11’s valuation correction highlights how regulatory risk, cash flow sustainability, and realistic valuation assumptions impact business value. The case offers critical lessons for investors and valuers on avoiding hype-driven multiples and ensuring defensible, risk-adjusted valuations in 2025.